Just want to get on the record so I can say “told you so” once it’s all over. Obama will get 300 electoral college votes, and it won’t be very close at all where it matters. Once again, the media wants to whip up the horse race so they have something to cover, but this race was over when the 47% were identified (along with other scary insights) by Mittens to his rich donors.

My Call

Nov 4

Here’s the latest sack of shit on the subject of carbon capture and storage (CCS) that has been around for a long time, but finally deserves some of my attention. In a reputable environmental publication this morning I read:

‘Renewables holding back CCS’: Government support for renewable technologies is to blame for the slow deployment of carbon capture and storage (CCS) technologies, Global CCS Institute CEO Brad Page has told the European Commission. In a September 21 speech in Brussels, Page said “CCS appears to be a victim” of distortionary govt support for expensive renewable energy technologies.

Unfortunately, it would appear that no one was available at the EC to say, “No, what is holding back CCS is that it is a Rube Goldberg scheme that will never work, so providing any money to support it in competition with any other viable technology is pissing that money down the drain.”

Here are the facts:

1. The second law of thermodynamics remains valid. Burning a solid or liquid hydrocarbon fuel is easy. However, capturing the resulting CO2 produced in hot gaseous form and turning it back into something cool and trapped in a liquid is both very complicated on the scale of a real power station and phenomenally costly on an energy and dollars basis.

2. CCS is not a permanent solution. By its very name, you know that what is intended is to store the CO2 in liquid, typically in underground reservoirs or liquid bearing formations. While pretty good at containing the high CO2 water, they are not perfect, and there is no long term guarantee that the CO2 stored in this fashion will not eventually leak out, reach the surface in one of several ways, and enter the atmosphere. So, CCS isn’t really a solution in the way that not generating CO2 is in the first place, such as through one of the other technologies that is being supported in the marketplace.

The people behind CCS are the fossil fuel power generators and fuel suppliers (like the coal industry). They say they are all about the market, except when the market (in this case the grants market) isn’t going their way.

Mark my words, there will never ever be a viable CCS process on the scale of an actual commercially operating power station, and even the overfunded pilot plants will never in my lifetime achieve results that warrant pursuing the chimera of CCS.

drip, drip, drip. . .

Aug 10

. . . crash! That’s how it happens. Did you see the Greenland melt this summer? Pretty impressive if you are into seeing rapid change. Things just creep along for a while, and you see smartarse climate deniers on the intertubes or fat box mouthing off about how one hard winter in NY (where that has happened pretty periodically since the ice age) is the proof that “global warming doesn’t exist, because its snowing in NY.” Then you start to see irrefutable shifts, like when water starts to boil after a long slow heating.

Where are those blow hards this summer, where something like 42,000 individual records for high temperatures have been recorded across the USA? Yeah, and I wasn’t doing it either, because I have the brains to know that an individual weather event does not mean anything in isolation. However, a statistically significant trend is another matter altogether. Check out the second video in this recent release from NASA.

I also notice one of the Koch brothers’ paid researchers has spent their money, did the additional research he proposed, and found precisely what has been reported by the IPCC is not only in fact true, but supported with additional weight by his research.

The only question that remains to be answered is, will the yanks actually wait until things are way to far gone to take any action, or can they still make a difference. Based on the rate of change it appears we may now be seeing, I guess I bet on the former.

But I’m a confirmed cynic.

via Krugman

May 21

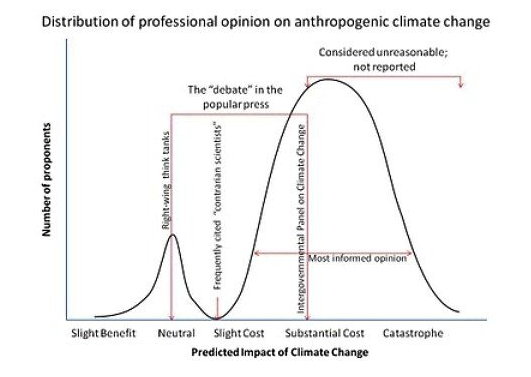

. . . well actually from Michael Tobis via Romm, via Krugman

A pretty accurate picture of something I have been talking about for a long time.

The small peak to the left is not, I suspect, even as large as actually represented, but if it is I am sure that has to do with the false equivalency presented by the mainstream media.

Nice to see the support of opinions I have held for a while being supported by those I admire in their area of expertise.

The one minute introduction to Synaptor is now available here

My company is a part owner of Synaptor, and we supplied the technical HSE backing to the IP in its products.

If you want to try the App on your iPhone or iPad it is a free download on the iTunes store. Also Android “soon” apparently. I would be appreciative of any feedback you have on the theory or application of the tool, or (as it turns out) your particular use for the tool beyond its original intention. A consultant in QLD is using it to keep a “live” hazard register on multiple sites that change every few months. My office manager keeps our whole hazards and effects register on it. I want to see some environmental ngo use it to make observations to keep tabs on big oil or big banks somewhere in the world.

But what it really does is lead you through an excellent HSE observation, if you need help. But of course a useful observation is really based on the conversation rather than a technical argument. And the truth is, lots of people don’t have a good technique (or recognise one they do have) and need to learn how to identify what works and what doesn’t. We will have a training course streaming through another App that is coming soon that will handle training records and competency matrix related tasks, as well as deliver the training content (if you don’t want to keep any records) for free. We intend to keep building tools to assist with the implementation of ISO compliant HSE Management systems and deliver them for free, or next to nothing, until we take over the world apparently. But I don’t lead that company.

I keep the fires on in the boring old HSE consulting business to make sure we don’t starve before that little startup goes.

Fearing fear itself

Mar 27

I recently read an article ominously entitled:

“SMEs will be hit with carbon tax reporting requirements”

The article is based on a survey performed by the Australian Institute of Management, and provides the opinion that small business (SMEs) will have carbon tax requirements passed on to them by the major emitters that pay the tax, when they are in the supply chain of the large companies. I think this article, while presenting some very interesting information, gets its analysis wrong for a couple of reasons that I detailed in comments to it, but unfortunately they were not accepted so I will present them here.

While I do expect large companies to require information from their supply chain regarding their activities and energy use so that the large emitters may complete their mandatory filings and purchasing of carbon credits, any attempt to turn the supply chain on its head and pass down costs to the supply chain will not be the result.

Further, I believe that the conclusion that a significant number of large businesses that make up the 700 or so companies that are currently covered by the NGERs legislation from 3 years ago, and will start having to pay the carbon tax in July will pass on requirements to their supply chain in a manner that is going to be detrimental in time and money costs on that supply chain is overstated.

The truth is, most of the NGERs companies that will be required to acquit permits at $23/ton to the Australian Government will be acquiring and acquitting those CO2-e credits (and therefore paying their tax) on the basis of CO2-e emissions that come from burning fossil fuels and manufacturing process industries. It is clear that based on these increased tax payments, electrical utility suppliers will pass on costs to everyone, including small business. But that may be the end of it for many SME’s, based on the nature of their operations.

Where any large business wants to “pass on” requirements to reduce emissions to its supply chain, or require the supply chain to document their emissions of CO2-e , this will mostly be passing on requirements to establish energy use/efficiency information in most cases, since suppliers are not primary emitters of CO2-e. Primary emitters of CO2-e are typically large electrical power generators and some high carbon intensity industries, like cement manufacturing. These large primary emitters are the subjects of the regulations of carbon emissions to meet the country’s long-term goals to reduce emissions. However, all businesses can benefit from examining their activities on the same basis that large companies are required to do.

Basically, all companies should see the carbon tax as a heads up that they should start to “internalise” their emissions of combustion products from fossil fuel burning and energy use. Any business (large or small) that gets that change in their mindset can then begin the process of determining where they are at with respect to their competiveness related to these additional characteristics of their performance.

As the only HSE Consultancy in Australia to be Carbon Neutral certified, my company (An Meá) has direct evidence that the process of documenting CO2-e performance (and even voluntarily participating in the CO2-e neutral programmes) is not difficult or that costly. Anyone telling you otherwise should be required to demonstrate their case in the same manner we can.

The only of those companies that have anything to fear are those that do not have any interest in what their energy efficiency is, or think climate change is a hoax. If you are in that basket, you are going the way of the dinosaur. However, if your organisation does not have a philosophical issue of doing something about CO2-e, or simply wants to benefit from energy efficiency, primarily, then you might see more benefits (and opportunities) than detriments.

More evidence piles up

Mar 26

Additional information is working its way into mainstream media regarding the number and severity of weather events, and whether they are possibly the result of climate changes. Its a question I have raised and discussed a of times (here or number here).

This was also coincidentally the subject of a discussion between myself and my buddy Otto recently. The bottom line, that I think I got his buy in on, although he remains skeptical about pretty much anything if left alone long enough, is that an average rise in temperature worldwide will be more likely to manifest itself as chaos due to an increase in entropy. Therefore, these latest scientifically verifiable observations support my thesis.

I understand that Dick Cheney’s operation has opened up the debate about whether he got special treatment or moved up the donors list.

I can tell you that while he may have used influence to get the kids heart (probably with lots of his blood while you are there), he certainly deserved it more than most on the list because he didn’t have one to begin with.

So, the Minerals Rent Tax has made it through the Senate and will become law on 1 July 2012, delivering a 30% tax on the wealth dug out of OUR ground by a few to make THEM bazillions. And despite the likely legal challenges from Twiggy on a constitutional basis that are unlikely to hold water {cough cough, petroleum rent tax at 40%}, the law is likely to hold. And fair enough. There is certainly nothing wrong with all of Australia sharing in the wealth of minerals we all own, and nothing unfair in taxation that is drawn from wealth that is currently being generated in Western Australia versus the more populous eastern states. Remember that it was only up until the very recent past that Western Australia wasn’t supported annually through sharing wealth of the east over here. You didn’t hear anything about unfairness of taxation from the sand-gropers when their schools and roads were all being subsidised by the folks out east. Remember, we may need them again when the boom goes bust, because the GDP in Australia is still primarily generated in NSW and VIC, despite the current mining boom (ref. Wikipedia)

But so as not to miss out on the news cycle that reported the Minerals Rent Tax, one of the current new developments that he is not suing anyone over, Clive Palmer instead waded into the conspiracy theory market, accusing Greenpeace of being funded by the CIA to undermine Australian coal exports. He’s already backing off the statements made, as he is demonstrably full of shit, but I bet the retractions don’t make the national radio and TV like the first assertions did. Funny that.

Now if Clive was really worried about a conspiracy of foreigners trying to shape the debate here in Australia, he would watch a bit of Media Watch and then look into the funding of the fluffy sounding Australian Environment Foundation, and Australian Climate Science Coalition. What he would see is that virtually all the funding coming from German and US agrichemical companies and the American Climate Science Coalition. The AEF and CSC promote views that are based on climate change denial from the US and have an agenda on the Murray Darling Basin that are not in the public interest as much as they are in the interest of the agrichemicals industry. Also very funny that.

Pity none of the networks that take statements from the AEF point out these connections when they are basically reading off the AEF’s media releases to meet their story deadlines, or that Clive isn’t railing on the TV about them.

Now I acknowledge that a lot of these super rich mining magnates got there by their own skill and hard work, but an equal number got there by coming from a life of privilege, their connections and inheritance, or simply making a big pile of money a huge pile of money by turning the handle on machine already invented for them.

That’s cunning, not intelligence. So the next time you are at something that Clive is presenting at, feel free to call him out on his bullshit, as you are more likely than not to win the argument. He has all the intellectual depth of a carpark puddle, and is possibly also going burko.

You ain’t no Darryl Kerrigan

Mar 15

I reckon Clive Palmer might have gone burko, and is having delusions about having gone to law school instead of into real estate as a young fellow. But whatever the cause, he has moved off free speech as his focus last week on the constitutionality of taxation this week. Busy guy. Perhaps he reckons he can do it all: run his magic dirt and mineral enterprise, fight the FFA/FIFA, fight the mining tax and fight the carbon tax all at once. Or perhaps he is a full of shit, bluffing windbag.

I’m not a constitutional lawyer, but here is why I will go with option 2:

1. The Federal government has the right to impose taxes and duties. This has been tested a number of times, but is pretty solid, based on the amount that my company and I pay every quarter. I don’t reckon Clive is on a winner, if he wants to take on the constitutionality of taxation in general.

2. The Federal government has the right to identify air pollutants of concern and regulate the collection of data on them and their emissions into the receiving environment. We have about 40 years of precedent in this area generally. With respect to CO2, the basis upon which the carbon tax will be collected is the data generated under the National Greenhouse and Energy Reporting (NGER), and despite the huge shit fight over its introduction in industry, no industry lobbying group (and all the big ones were involved) ever suggested it was unconstitutional. It has also passed muster on the basis of sound scientific methodology, so there goes any arbitrary and capricious argument.

3. The Federal or State governments have the right to apply fees (or taxes) to companies that want to discharge pollutants to the common environment in their jurisdiction. Tipping fees, sewage charges and even air pollutant emissions are charged by State and Local governments now, and the extension of this to the Federal Government is not a huge reach in logic. He might be attempting the challenge in this area on the basis of an argument of Intergovernmental Immunity (thank you Wikipedia):

“… the Engineers’ Case held that there was no general immunity between State and Commonwealth governments from each other’s laws, the Commonwealth cannot enact taxation laws that discriminated between the States or parts of the States (Section 51(ii)), nor enact laws that discriminated against the States, or such as to prevent a State from continuing to exist and function as a state”

He may also want to make an argument based on an argument that the new law does not fall within a permissible head of power granted to the Commonwealth government by the Constitution.

While either of these is a possible route of attack, the case of the Carbon Tax being applied to the whole of the country is not likely to be found to be discriminatory against any state, and if this type of taxation of a pollutant is found to be a States’ right rather than the Commonwealth, there are one or more easy workarounds to deliver the intent.

4. But the most obvious reason this constitutional challenge isn’t going to hold water came from Clive himself. Clive was not willing to leak the details on the 730 Report of the precise basis of the means by which the carbon tax is unconstitutional. If he had anything, he’d come out with it. See, constitutional law isn’t like a regular tort. It isn’t like Clive would benefit by hiding his most excellent constitutional argument for a packed courtroom, spring it on the packed house and unsuspecting government barristers, get a judgement and penalty in his favour on the day and be carried off on the shoulders* of his supporters and then next day be much richer. If he had anything worth a damn, he would have won the argument last night with it.

Now, if there were some technicality that did allow the High Court to rule the carbon tax unconstitutional, the government would merely find another means by which to attach its revenue generating mechanism to existing sources to achieve the same effect**. For instance, it could use the NGER data collected to establish the amount owed by each business, then reduce the amount of GST or mining tax revenue returned to the individual states with the identification of the business that the reduction was due to, then suggest that the State recoup that revenue through rate-based licensing regulations that are already on the books by simply adding CO2-e to the pollutants of concern that they “tax” now.

But let’s hope Clive gets lots of lawyers in Sydney and Canberra involved, because that part of the country needs some stimulus. It would really nice if, like in a tort, the Federal government could recoup its costs from Clive when he is unsuccessful.

* if you could even picture that

** as it says right in the legislation, a similar case to many other precedents where a specific law was found unconstitutional, but that did not prevent the Commonwealth from delivering the intent of the law through other mechanisms.