Tax, as it is said, is the price we pay for civilisation. So as we begin the shouting, gnashing of teeth and get deluged with millions of dollars in advertising over whether a carbon tax here in Australia is going to destroy our economy or not, it would be nice to have an honest conversation for a change. I found a little bit of that honesty when I was reading Paul Krugman again the other day, between the lines of the point he was trying to make.

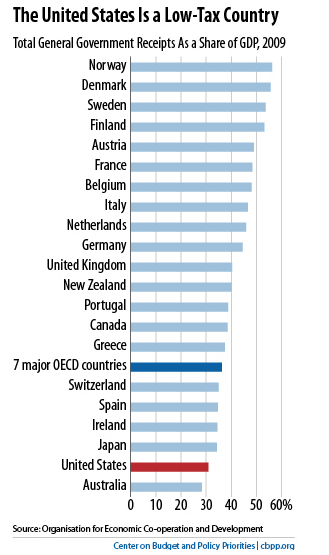

The graph in the Professor’s post shows overall government revenues as a percent of GDP for a number of countries, as below:

The key point that he was trying to make is what a low-tax country the USA is, in comparison to all the current demonising of all government and taxes that the right is trying to do there again. But the point it made to me is not the red bar for the USA, but the one below it. See, the truth is that Australia, even with our single-payer health system, uniform funding for schools out of general revenue (not property tax), and generally more social welfare than in the USA, actually do it all for less money than the USA on a normalised basis. Now how does that work?

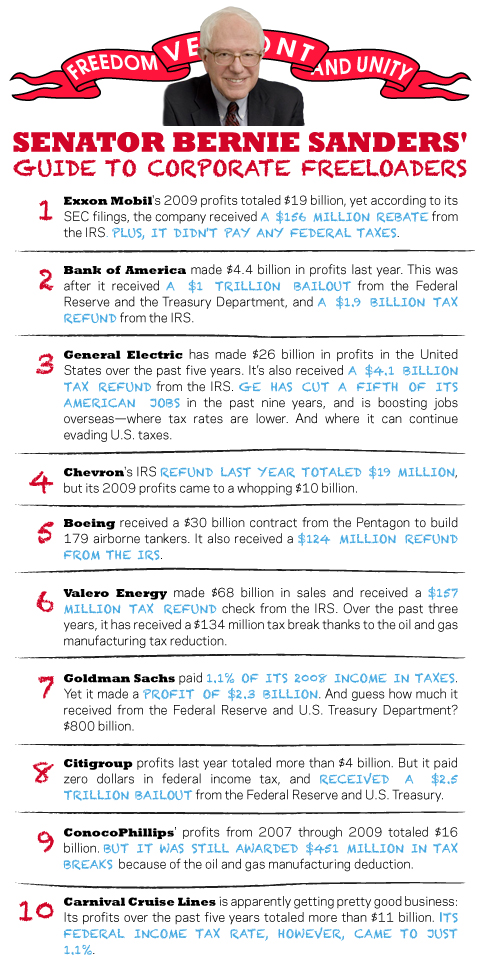

Well, I haven’t finished my research yet, but I have a big feeling that the first big difference has to be that we don’t lie to ourselves as much. See, Americans have a great constitution, and a bill of rights, and pretty universal voting rights. But they got all those things long ago and haven’t really used them much since, that I think they have become complacent and still believe they have a functioning democracy. The truth is, the political system and public discourse through media in the US are so dominated by moneyed interests, that they virtually never have an honest conversation about serious issues like the role of government and what it costs (tax). Ever since I remember first having a political discussion in relation to the presidential primary between Bush I and Reagan, I have heard continually in virtually every discussion about the issue the fake truism that the US is taxed too highly. The discussion is pretty much always handled very simplistically and centres around rates. And it is easy to swing opinion to the side of the fake truism with the majority of people who draw a paycheck from an employer. They understand it: take your gross salary, multiply it by the rate and thats the tax the government gets from you. But what they don’t work through is the way most companies, and wealthy people do their tax with deductions, special tax subsidies, losses that can be carried forward and the different treatment of earned and unearned income. When you factor those things in that make up a huge portion of the US tax code, the result are absurdities such as those below as compiled by Senator Bernie Sanders (I-VT):

See, only suckers really pay the full 30% rate for corporations. The same is true for individuals paying tax, which is why the US can end up collecting so little revenue as a portion of GDP.

So, when I hear yesterday here in Australia that the government is now at 31% support, and that 60% of people now oppose a carbon tax, I wonder if we in Australia are also now buying into the sort of lies that have worked their “magic” in the USA. The truth is, we are also a very low tax country. The truth is that the carbon tax is going to have very little impact on the economy in Australia, and will also be made more fair to lower income households through the compensation already announced. We will even then still be able to afford to fund good things, and provide some relief to companies that are energy intensive and exposed to international trade.

And even though I generally support unions, if the unions here in Australia require that not one job be lost in order to address climate change, then its time for them to get honest with themselves as well. The truth is jobs digging up and burning the magic dirt have to go, and it won’t be a bad thing unless your only goal is to maintain the status quo.

At some point everyone needs to ask themselves, “What is my civilisation worth?”.