You gotta love it when Krugman quotes David Bowie songs, and has intimate knowledge on zombies. Like making sure you use the double-tap.

Archive for April, 2011

A regular dude

Apr 24

An honest discussion on tax

Apr 19

Tax, as it is said, is the price we pay for civilisation. So as we begin the shouting, gnashing of teeth and get deluged with millions of dollars in advertising over whether a carbon tax here in Australia is going to destroy our economy or not, it would be nice to have an honest conversation for a change. I found a little bit of that honesty when I was reading Paul Krugman again the other day, between the lines of the point he was trying to make.

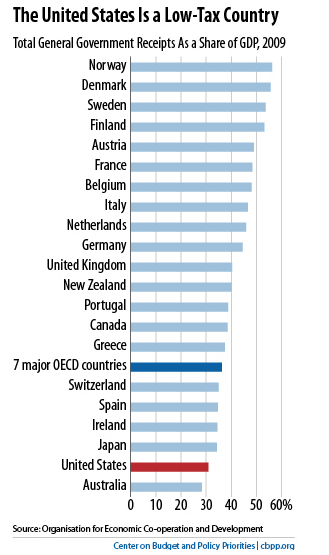

The graph in the Professor’s post shows overall government revenues as a percent of GDP for a number of countries, as below:

The key point that he was trying to make is what a low-tax country the USA is, in comparison to all the current demonising of all government and taxes that the right is trying to do there again. But the point it made to me is not the red bar for the USA, but the one below it. See, the truth is that Australia, even with our single-payer health system, uniform funding for schools out of general revenue (not property tax), and generally more social welfare than in the USA, actually do it all for less money than the USA on a normalised basis. Now how does that work?

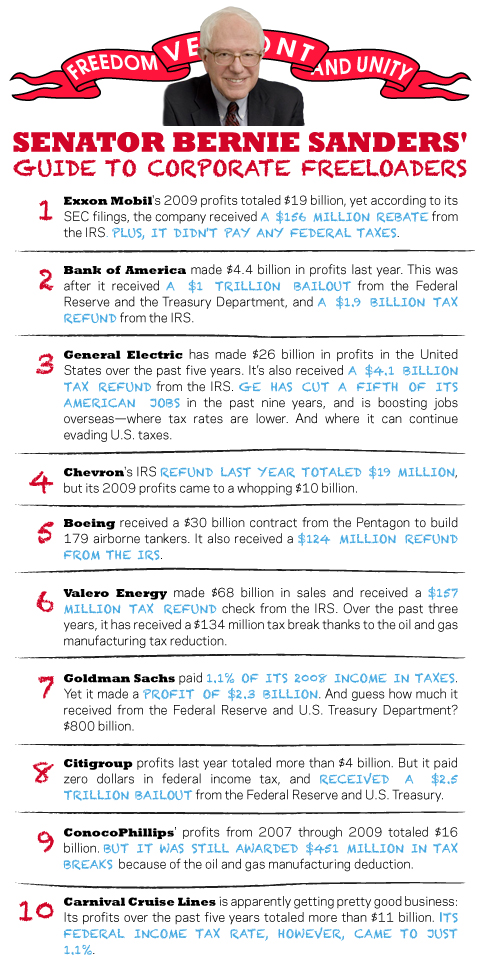

Well, I haven’t finished my research yet, but I have a big feeling that the first big difference has to be that we don’t lie to ourselves as much. See, Americans have a great constitution, and a bill of rights, and pretty universal voting rights. But they got all those things long ago and haven’t really used them much since, that I think they have become complacent and still believe they have a functioning democracy. The truth is, the political system and public discourse through media in the US are so dominated by moneyed interests, that they virtually never have an honest conversation about serious issues like the role of government and what it costs (tax). Ever since I remember first having a political discussion in relation to the presidential primary between Bush I and Reagan, I have heard continually in virtually every discussion about the issue the fake truism that the US is taxed too highly. The discussion is pretty much always handled very simplistically and centres around rates. And it is easy to swing opinion to the side of the fake truism with the majority of people who draw a paycheck from an employer. They understand it: take your gross salary, multiply it by the rate and thats the tax the government gets from you. But what they don’t work through is the way most companies, and wealthy people do their tax with deductions, special tax subsidies, losses that can be carried forward and the different treatment of earned and unearned income. When you factor those things in that make up a huge portion of the US tax code, the result are absurdities such as those below as compiled by Senator Bernie Sanders (I-VT):

See, only suckers really pay the full 30% rate for corporations. The same is true for individuals paying tax, which is why the US can end up collecting so little revenue as a portion of GDP.

So, when I hear yesterday here in Australia that the government is now at 31% support, and that 60% of people now oppose a carbon tax, I wonder if we in Australia are also now buying into the sort of lies that have worked their “magic” in the USA. The truth is, we are also a very low tax country. The truth is that the carbon tax is going to have very little impact on the economy in Australia, and will also be made more fair to lower income households through the compensation already announced. We will even then still be able to afford to fund good things, and provide some relief to companies that are energy intensive and exposed to international trade.

And even though I generally support unions, if the unions here in Australia require that not one job be lost in order to address climate change, then its time for them to get honest with themselves as well. The truth is jobs digging up and burning the magic dirt have to go, and it won’t be a bad thing unless your only goal is to maintain the status quo.

At some point everyone needs to ask themselves, “What is my civilisation worth?”.

Tester and Baucus

Apr 7

I got a letter from a US Senator and started a conversation with his staff today. Not my Senator of course, as that would technically speaking be the either of the two Senators mentioned in the title. But he is a solid guy with good principles he believes in, so always respond to him. My guys never seem to change their behaviour or address my specific concerns as a result my correspondence with them, so I will let loose on them here. Anyway, the Senator’s staff (because, you know, you are never really talking to a Senator unless you can touch them) wanted to know my thoughts on how do we bring down the deficit, based on his suggestions:

• End the exclusive tax breaks available only to millionaires and billionaires.

• End the subsidies for the highly-profitable oil and gas industries.

• Bring the wars in Iraq and Afghanistan to a responsible end.

• Get our economy back on track – by investing in education and clean energy technology, boosting manufacturing, and keeping families in their homes by fixing the broken housing market.

I responded to him in the positive, as his suggestions are all positive. A refreshing change. And I provided some positive suggestions of my own.

On taxes and corporate subsidies, let’s get back to capitalism and free-market taxation systems. A good business does not need the government to make it, or keep it healthy. So shame on you Exxon, GE, Bank of America, etc., etc., etc. for paying no tax. Businesses are inherently good things, a collection of people (primarily) and other resources for a common good well beyond themselves that make an economic system function. So where those entities are participating in the economic system providing stuff and requiring labour, fantastic. In fact, as entities, they should pay a lower tax rate than a human being. But not no tax at all. So the USA needs to have a serious discussion at some point about addressing ALL tax loopholes that are used by major corporations of ALL types to minimise their tax in a way that smells suspiciously like avoidance.

Then my main point was about the defence budget. The USA will never seriously deal with the national debt if it maintains a military budget that is larger than all other militaries combined. Even at half of the current spend it would still leave a US military that would still be larger than all non-NATO countries. Why the paranoia in the USA about security? Most the yanks I know are the most secure and free people I know on the earth today. Does the USA honestly need to maintain a military that can take on NATO after defeating its real enemies?

Honestly, you can live your principles and keep yourself a lot safer a lot cheaper than maintaining a huge military, and the associated industrial complex to support and feed off of it.

Now you are never going to get a reduction of half, so why not go for something reasonable, like 40%. I expect that a serious discussion/fight over the subject could result in something like a reduction of 25% in the short term, with a ramp down to whatever is reasonable in the future (what, 50% at all times not going to make you feel good enough to sleep at night?). That is still a win as there will be a cut of $225 billion (all military, but not including the black ops budget). How about that for a debt and corresponding interest payment reduction? See, that’s what Americans mean when they tell you they want the government to treat its budget like a family budget. Reduce debt and interest when you can responsibly. But, perhaps it wouldn’t be responsible in the short term to use all that savings to pay off debt today. Perhaps there are some things the USA should move to spend money on in the Senator’s last point that may need to take priority over debt reduction. That $225 billion is supporting a lot of jobs, and the USA will need to shift, retrain and retire a lot of people. Or leave them to their own devices as you tell them the war factories are closing, but that is also a topic for later discussion.

When seriously discussing other cuts, focus the rest of your priorities on the elimination of fraud, waste, redundancy and inefficiency, but realise the diminishing returns of finding these opportunities. Start from the basis that people are generally honest, and companies are by definition amoral.

And for fuck sake don’t go into those serious discussions and offer everything your adversaries want in negotiation straight away, ala the President. Honestly, I don’t know what he is thinking sometimes, and I don’t believe when he has used this tactic previously that it fits into any long term strategy he has to lose tactically but win strategically. If it did, we would be talking about the simple details of a single payer health care system instead of also talking about eliminating Medicare and Medicaid in the USA. You have to go into these fights strongly defending a position based on your principles and fight it out hard. I am much more interested in times such as these to support those that fight the good fight to the end, even if they lose.

Aren’t you?

OK, its time for a bit more math, but basically the amount required is pretty much going to be about $1.05. Here’s the facts for you to work with.

The Australian Department of the Treasury has announced that before assistance costs that will trickle down through all the sectors of the economy will cost the average household in Australia (worst case) $860 a year, assuming carbon costs $30/ton in tax.

Using my previous estimates of total emissions upon which the tax is payable results in a massive $10 billion of revenue for the government, and more than cover a compensation program to reduce the $860 a year to pretty much any amount you want, as well as fund appropriate research and investment into long term renewables.

But to be honest, it doesn’t have to be a program that big. Let’s say, for instance, that we set the price not at my previous lowball $15/ton, but rather split the difference between that amount and this whopping big program, and go with a price of $23/ton. This price is relatively familiar to those that have been trading in international carbon markets for the last few years, so it seems like a good balance.

OK, so we raise $7.67 billion in carbon tax at $23/ton, and fund all the good programs I identified previously with about 2/3rds of the money ($5.26 billion) and return the rest ($2.41 billion) to the 8.75 million households in Australia on monthly basis resulting in a net cost to them of $383.25 a year, or $1.05 a day.

And if you won’t kick in $1.05, who will?

I mean, if you have seen the movie reference here, and know the social commentary in it, you will see what a accurately portrayed view of our pathetic existence it is, rather than a near perfect parody using puppets. I believe we will really prove this point, and have a ready made theme song to go with it (on a slightly different theme), and still we won’t be able to get the common user to kick in a buck-o-five to solve a problem when it is almost too late. Frankly, we deserve zombies.

However, on an up note, finally, I am glad to see dolt* get the treatment he deserves on the ABC from Jonathan Holmes, and I am glad I am not the only one that thinks dolt’s bullying should be stood up to. His strawman argument of the cost to Australia versus the actual reduction in temperature that will be seen immediately is as offensive as his views on aboriginals that is currently on trial in Victoria.

* – see, he is already diminishing in importance and doesn’t even rate capitalisation. He’s just another anonymous dolt.